How much is 300000 after tax in florida?

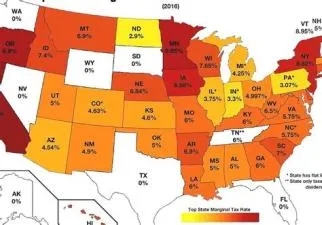

Why does florida have no income tax?

How Florida Has No Income Tax. In 1968, the Florida Constitution was ratified to prevent the state from collecting an income tax. And the state constitution protects taxpayers from having the state impose new taxes or raise them.

2024-02-18 19:23:39

How much can you win in a casino without paying taxes florida?

If the winnings minus the wager exceed $5,000 and the winnings are at least 300 times the wager, the gambling establishment is required to withhold 24% of the proceeds, which they then pay over to the government.

2023-04-03 11:04:01

Can you cash a ny lottery ticket in florida?

You can only cash a lottery ticket in the jurisdiction/state in which it was purchased. This includes multi-state lottery tickets such as the Powerball and the Mega Millions

Mega Millions

A mega number, also known as a powerball, mega ball, or bonus ball, is a number drawn in a lottery game that comes from a second number field, rather than among the game's "regular" numbers. As of 2015, forty-six U.S. lotteries offer Mega Millions and Powerball. These games each use two sets of numbers.

https://en.wikipedia.org › wiki › Mega_number

Mega number - Wikipedia

. Multi-state lottery tickets are actually sold by the individual state lottery commision for the state in which you buy it.

2023-03-03 19:26:45

Does florida have to pay taxes on lottery winnings?

If you buy a winning Mega Millions

Mega Millions

A mega number, also known as a powerball, mega ball, or bonus ball, is a number drawn in a lottery game that comes from a second number field, rather than among the game's "regular" numbers. As of 2015, forty-six U.S. lotteries offer Mega Millions and Powerball. These games each use two sets of numbers.

https://en.wikipedia.org › wiki › Mega_number

Mega number - Wikipedia

ticket in California, Delaware, Florida, New Hampshire, South Dakota, Tennessee, Texas, Washington or Wyoming, there's some good news for you: those states do not tax lottery winnings. This means if you live in those states and win, you will get $139,267,045.

2023-01-06 15:19:55

- how many calories walk mile

- how much does a medium potato weigh

- dirty dabbers

- seminole tribe net worth

- apex fuse heirloom

- Recommended Next Q/A:

- Do we run out of lithium?