When did california stop inheritance tax?

How much tax do you pay on a 1000 scratch off ticket in california?

There are generally no California state taxes for Lottery prizes, but we are required to withhold federal taxes.

2024-02-14 01:49:11

How much does california tax mega millions?

That means winners in California and New York would take home different amounts: California doesn't tax lottery winnings, while New York levies a 10.9% final tax.

2024-01-19 14:47:47

When did gambling tax stop uk?

Lotteries. A statute of 1698 provided that in England lotteries were by default illegal unless specifically authorised by statute.

2023-08-09 19:46:54

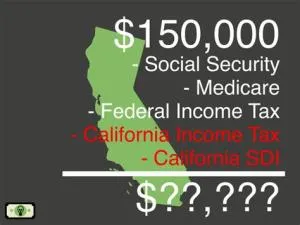

How much is 150k usd after tax in california?

If you make $150,000 a year living in the region of California, USA, you will be taxed $51,174. That means that your net pay will be $98,826 per year, or $8,235 per month.

2023-07-02 18:39:24

- Recommended Next Q/A:

- Why cant i play with my friends on mhr?